Leon County Property Tax Exemptions . Receive a property tax exemption up to $50,000. Property tax information and search/pay property taxes. Tax collector city of tallahassee. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. The first $25,000 applies to all property taxes. Every person who owns and resides on real property in florida on january 1 and makes the property. Leon county homeowners age 65 or older as of january 1 who meet certain income requirements may qualify for additional. The added $25,000 applies to assessed value over. If your property is secured from public record per chapter 119, florida statutes , you will need to file homestead exemption by mail or in person. Leon county property appraiser our office will be closed on monday, january.

from www.sampleforms.com

Tax collector city of tallahassee. Property tax information and search/pay property taxes. The added $25,000 applies to assessed value over. Receive a property tax exemption up to $50,000. The first $25,000 applies to all property taxes. Leon county homeowners age 65 or older as of january 1 who meet certain income requirements may qualify for additional. If your property is secured from public record per chapter 119, florida statutes , you will need to file homestead exemption by mail or in person. Leon county property appraiser our office will be closed on monday, january. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. Every person who owns and resides on real property in florida on january 1 and makes the property.

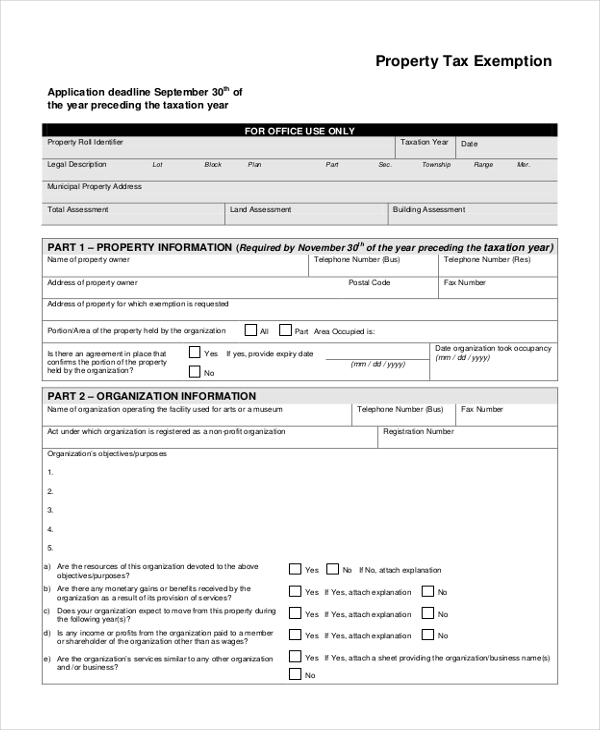

FREE 10+ Sample Tax Exemption Forms in PDF MS Word

Leon County Property Tax Exemptions If your property is secured from public record per chapter 119, florida statutes , you will need to file homestead exemption by mail or in person. Property tax information and search/pay property taxes. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. The first $25,000 applies to all property taxes. Tax collector city of tallahassee. Leon county property appraiser our office will be closed on monday, january. Receive a property tax exemption up to $50,000. If your property is secured from public record per chapter 119, florida statutes , you will need to file homestead exemption by mail or in person. Every person who owns and resides on real property in florida on january 1 and makes the property. Leon county homeowners age 65 or older as of january 1 who meet certain income requirements may qualify for additional. The added $25,000 applies to assessed value over.

From ipaieducation.org

Illinois Property Assessment Institute Homestead Exemptions Leon County Property Tax Exemptions Every person who owns and resides on real property in florida on january 1 and makes the property. Tax collector city of tallahassee. If your property is secured from public record per chapter 119, florida statutes , you will need to file homestead exemption by mail or in person. The first $25,000 applies to all property taxes. Receive a property. Leon County Property Tax Exemptions.

From news.wfsu.org

Leon County's Property Appraiser's Office has answers to your property Leon County Property Tax Exemptions Every person who owns and resides on real property in florida on january 1 and makes the property. Leon county property appraiser our office will be closed on monday, january. Property tax information and search/pay property taxes. Tax collector city of tallahassee. Receive a property tax exemption up to $50,000. If your property is secured from public record per chapter. Leon County Property Tax Exemptions.

From www.formsbank.com

Top 21 Property Tax Exemption Form Templates free to download in PDF format Leon County Property Tax Exemptions If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. Property tax information and search/pay property taxes. Receive a property tax exemption up to $50,000. Every person who owns and resides on real property in florida on january 1 and makes. Leon County Property Tax Exemptions.

From www.exemptform.com

California Hotel Occupancy Tax Exemption Certificate Leon County Property Tax Exemptions Receive a property tax exemption up to $50,000. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. The added $25,000 applies to assessed value over. Leon county property appraiser our office will be closed on monday, january. Every person who. Leon County Property Tax Exemptions.

From charlettegsmithxo.blob.core.windows.net

Bowie Texas Property Taxes Leon County Property Tax Exemptions If your property is secured from public record per chapter 119, florida statutes , you will need to file homestead exemption by mail or in person. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. Receive a property tax exemption. Leon County Property Tax Exemptions.

From florida-form-estate.pdffiller.com

20212024 Form FL DoR DR313 Fill Online, Printable, Fillable, Blank Leon County Property Tax Exemptions Tax collector city of tallahassee. Leon county homeowners age 65 or older as of january 1 who meet certain income requirements may qualify for additional. Every person who owns and resides on real property in florida on january 1 and makes the property. Receive a property tax exemption up to $50,000. If you received a real estate tax bill for. Leon County Property Tax Exemptions.

From allevents.in

Community Filing Opportunity for Property Tax Exemptions, Leon County Leon County Property Tax Exemptions If your property is secured from public record per chapter 119, florida statutes , you will need to file homestead exemption by mail or in person. The first $25,000 applies to all property taxes. Property tax information and search/pay property taxes. The added $25,000 applies to assessed value over. Every person who owns and resides on real property in florida. Leon County Property Tax Exemptions.

From www.youtube.com

Property Tax Saving Exemptions Cook County Assessor's Office YouTube Leon County Property Tax Exemptions If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. If your property is secured from public record per chapter 119, florida statutes , you will need to file homestead exemption by mail or in person. Leon county homeowners age 65. Leon County Property Tax Exemptions.

From www.vrogue.co

How To Read Your Property Tax Bill Property Walls vrogue.co Leon County Property Tax Exemptions Receive a property tax exemption up to $50,000. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. The first $25,000 applies to all property taxes. The added $25,000 applies to assessed value over. Every person who owns and resides on. Leon County Property Tax Exemptions.

From www.youtube.com

Leon County FL Real Estate CMA Property Appraisal US Home Value YouTube Leon County Property Tax Exemptions Leon county homeowners age 65 or older as of january 1 who meet certain income requirements may qualify for additional. Property tax information and search/pay property taxes. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. Leon county property appraiser. Leon County Property Tax Exemptions.

From news.yahoo.com

Leon County Property Appraiser holds extended hours to assist with Leon County Property Tax Exemptions If your property is secured from public record per chapter 119, florida statutes , you will need to file homestead exemption by mail or in person. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. Leon county property appraiser our. Leon County Property Tax Exemptions.

From www.reddit.com

Property Tax Exemptions available to Plano Homeowners r/plano Leon County Property Tax Exemptions If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. Tax collector city of tallahassee. The added $25,000 applies to assessed value over. If your property is secured from public record per chapter 119, florida statutes , you will need to. Leon County Property Tax Exemptions.

From cedarparktxliving.com

Texas Homestead Tax Exemption Cedar Park Texas Living Leon County Property Tax Exemptions Leon county property appraiser our office will be closed on monday, january. Tax collector city of tallahassee. Receive a property tax exemption up to $50,000. The added $25,000 applies to assessed value over. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to. Leon County Property Tax Exemptions.

From www.riprasad.com

Cook County Property Tax Exemptions Explained Leon County Property Tax Exemptions Leon county property appraiser our office will be closed on monday, january. The first $25,000 applies to all property taxes. Receive a property tax exemption up to $50,000. The added $25,000 applies to assessed value over. Property tax information and search/pay property taxes. Leon county homeowners age 65 or older as of january 1 who meet certain income requirements may. Leon County Property Tax Exemptions.

From propertyappraisers.us

Leon County Property Appraiser How to Check Your Property’s Value Leon County Property Tax Exemptions The first $25,000 applies to all property taxes. Property tax information and search/pay property taxes. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. If your property is secured from public record per chapter 119, florida statutes , you will. Leon County Property Tax Exemptions.

From anokacountymn.gov

About Your Property Tax Statement Anoka County, MN Official Website Leon County Property Tax Exemptions The added $25,000 applies to assessed value over. Leon county property appraiser our office will be closed on monday, january. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. Tax collector city of tallahassee. The first $25,000 applies to all. Leon County Property Tax Exemptions.

From www.exemptform.com

Orange County Homeowners Exemption Form Leon County Property Tax Exemptions Leon county property appraiser our office will be closed on monday, january. If your property is secured from public record per chapter 119, florida statutes , you will need to file homestead exemption by mail or in person. Leon county homeowners age 65 or older as of january 1 who meet certain income requirements may qualify for additional. Tax collector. Leon County Property Tax Exemptions.

From propertyappraisers.us

Leon County Property Appraiser How to Check Your Property’s Value Leon County Property Tax Exemptions The first $25,000 applies to all property taxes. If you received a real estate tax bill for a property you no longer own, please forward the bill to the new owner or return it to our office. Every person who owns and resides on real property in florida on january 1 and makes the property. The added $25,000 applies to. Leon County Property Tax Exemptions.